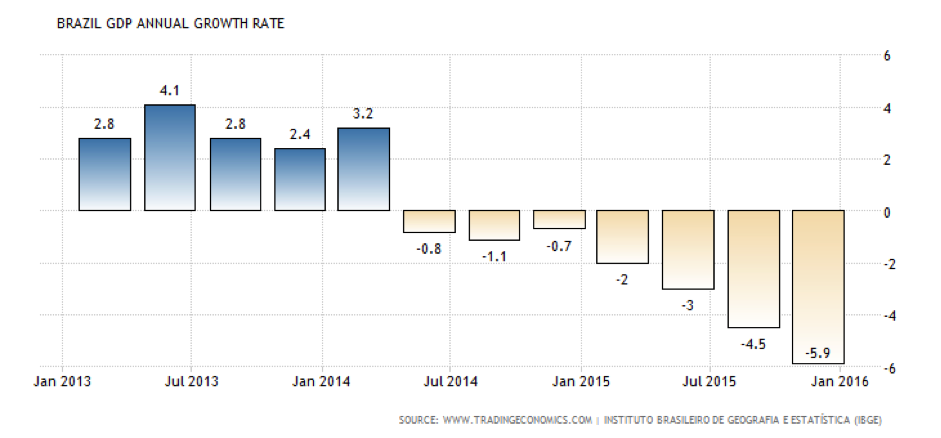

The country is now in its deepest recession in at least two decades. Many predict it will endure its worst economic period since the early 20th century before positive growth is seen again.

China’s economic slowdown and a severe contraction in its demand for commodities are among the main factors that have crippled Brazil’s economy. Trade between Brazil and China exploded from $2 billion in 2000 to hit $83 billion by 2013, with Brazil’s commodity exports to China as the predominant mode of business.

The example of Vale aptly illustrates this point. Brazil’s mining giant (and the world’s biggest iron ore producer) was forced to access $3 billion of emergency credit in late 2015 to secure financing so it could complete deals to sell off several of its operations, since China’s once-explosive growth in steel-making – a process in which iron ore is a key ingredient – had cooled off considerably. Iron-ore prices consequently plummeted, from more than $180 per tonne in 2011 to $40 per tonne in January 2016, although there has been a modest recovery since then. As a result, Vale has had to shelve many projects deemed unprofitable at current market prices.

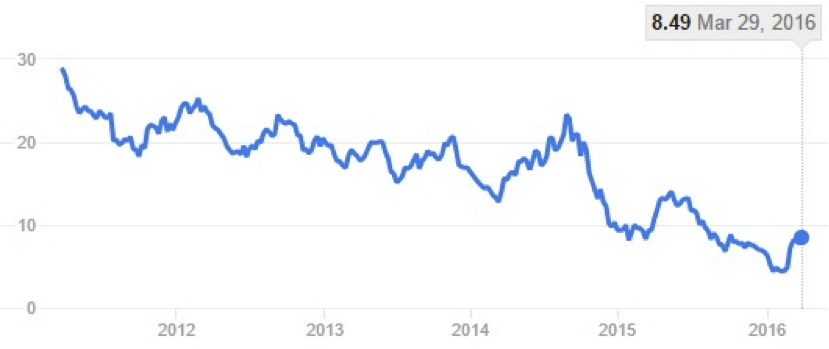

Arguably the worst problem Brazil has faced in recent times has been the Petrobras corruption scandal. The state-owned oil producer – Brazil’s largest company – had diverted money into funds to support politicians in return for obtaining favourable construction contracts. The Supreme Federal Court is now investigating many high-ranking politicians, including members of National Congress, numerous politicians from current President Dilma Rousseff’s Workers’ Party and even former President Silva. In relation to the scandal, the head of the country’s biggest construction firm, Odebrecht, is also now in jail. Petrobras’ corruption-related losses were calculated to total over $5 billion by the end of 2015.

Petrobras share price 2011-2016 ($)

Petrobras is now among the most indebted companies in the oil and gas sector, resulting in its credit rating being downgraded to junk status. Moreover, as oil prices have collapsed since mid-2014, Petrobras has had to revise its 2015-19 investment plan downwards while also forecasting a drop in production for this year.

The outbreak of the Zika virus in the northeast area of the country has not helped matters either; it’s estimated that approximately 2 million Brazilians have been affected. The epidemic has caused a surge in reported cases of microcephaly in newborns. The World Health Organisation called the outbreak “a global health emergency” last month, while the Doctors’ Union of Rio de Janeiro believes the health sector is too weak to support the influx of people for this summer’s Olympics. According to the union’s president, Jorge Darze, “the possibility of tourists contracting diseases such as Zika and not being able to find sufficient support” is of grave concern.

One of the few items of good news is Brazil’s trade surplus, which at $3.0bn for February has dampened the extent of negative growth. The increase in exports revenue, particularly from the manufacturing sector, represents a rare source of optimism in a country otherwise mired in recession, scandal and a complete collapse in public confidence.

Impeachment proceedings are culminating with the possibility that Rousseff could be ousted in the near future. Brazil’s electoral tribunal is investigating whether campaign donations for her second-term election victory in 2014 were used to alter public accounts and hide the size of Brazil’s huge budget deficit. As a result, Brazilian economists have recently improved their economic outlook for the country, forecasting a recession of 3.66% negative growth this year, followed by a 0.35% contraction in 2017 (from a previous projection of 0.44%).

The real has also gained by 9% this month, although Brazil’s central bank expects the currency to keep tumbling throughout the year. This will continue to make it tougher for Brazilian companies, which have racked up the world’s second-largest amount of dollar-denominated debt. Imports have also increased in price, spurring domestic competitors to raise their own prices and thus creating inflation. With interest rates now at their highest levels in nearly 10 years, the central bank is reluctant to raise them further. Rate hikes seem ineffective and will only increase Brazil’s public debt, which already stands at around 70% of GDP. At present, there seems no easy way out for Brazil’s beleaguered economy. Nonetheless, long-term investment opportunities are often found when situations appear most dismal.