We have all been hearing the incredible stories of high growth throughout the developing world. As investors seek the potential for higher returns and increased diversification, more and more funds are being allocated to emerging market equities and bonds. While there is no globally accepted definition of a developing nation – the IMF takes into account, per capita income levels, export diversification, and the degree to which the country is integrated into the global financial system – a number of countries which were formally classified as lesser developed nations have improved dramatically based on several well known economic metrics and it seems that the wheels are set in motion for continued growth. But investors must be fully aware of the historical context as well as the main factors driving growth in these “new markets”; they need to question whether these elements are enough to sustain growth and create the returns they need going forward. More directly, how likely are these markets to remain strong and for how long?

We have all been hearing the incredible stories of high growth throughout the developing world. As investors seek the potential for higher returns and increased diversification, more and more funds are being allocated to emerging market equities and bonds. While there is no globally accepted definition of a developing nation – the IMF takes into account, per capita income levels, export diversification, and the degree to which the country is integrated into the global financial system – a number of countries which were formally classified as lesser developed nations have improved dramatically based on several well known economic metrics and it seems that the wheels are set in motion for continued growth. But investors must be fully aware of the historical context as well as the main factors driving growth in these “new markets”; they need to question whether these elements are enough to sustain growth and create the returns they need going forward. More directly, how likely are these markets to remain strong and for how long?

Decades Ago

A few decades ago, when we thought of the countries throughout much of Asia, Latin America, Eastern Europe, Africa, and the Caribbean, most of which are now classified as “emerging markets”, we envisioned economies that were stagnant, rural, and agrarian, faced with rampant inequality and absolute poverty, and with many still struggling from the effects of colonial rule. Indeed that was not an unreasonable picture, then. According to Michael P. Todaro, Professor of Economics at New York University, developing nations were often challenged by elements such as the aforementioned.

The problems may have differed slightly in scope and magnitude from one country to the next, but most faced similar constraints. We have observed from an economic perspective lower level of human capital, but certainly not human potential, in developing economies. There is strong evidence that this has been the result of sub-par educational institutions, poor health care facilities and lower participation of women in certain activities.

According to economists, such as Todaro, it was commonplace to see higher levels of inequality, in income and wealth, with a majority of the riches residing with only a few citizens. Population growth rates have traditionally been higher, with larger rural populations but rapid rural-to-urban migration, but this is not bad in all circumstances.

Other common traits include lower levels of industrialization and manufactured exports, undeveloped banking and capital markets systems, and greater relative importance of public versus private sector. Decades ago, this combination of circumstances prevented lesser developed nations from adequately participating in the global growth story.

Recent Years

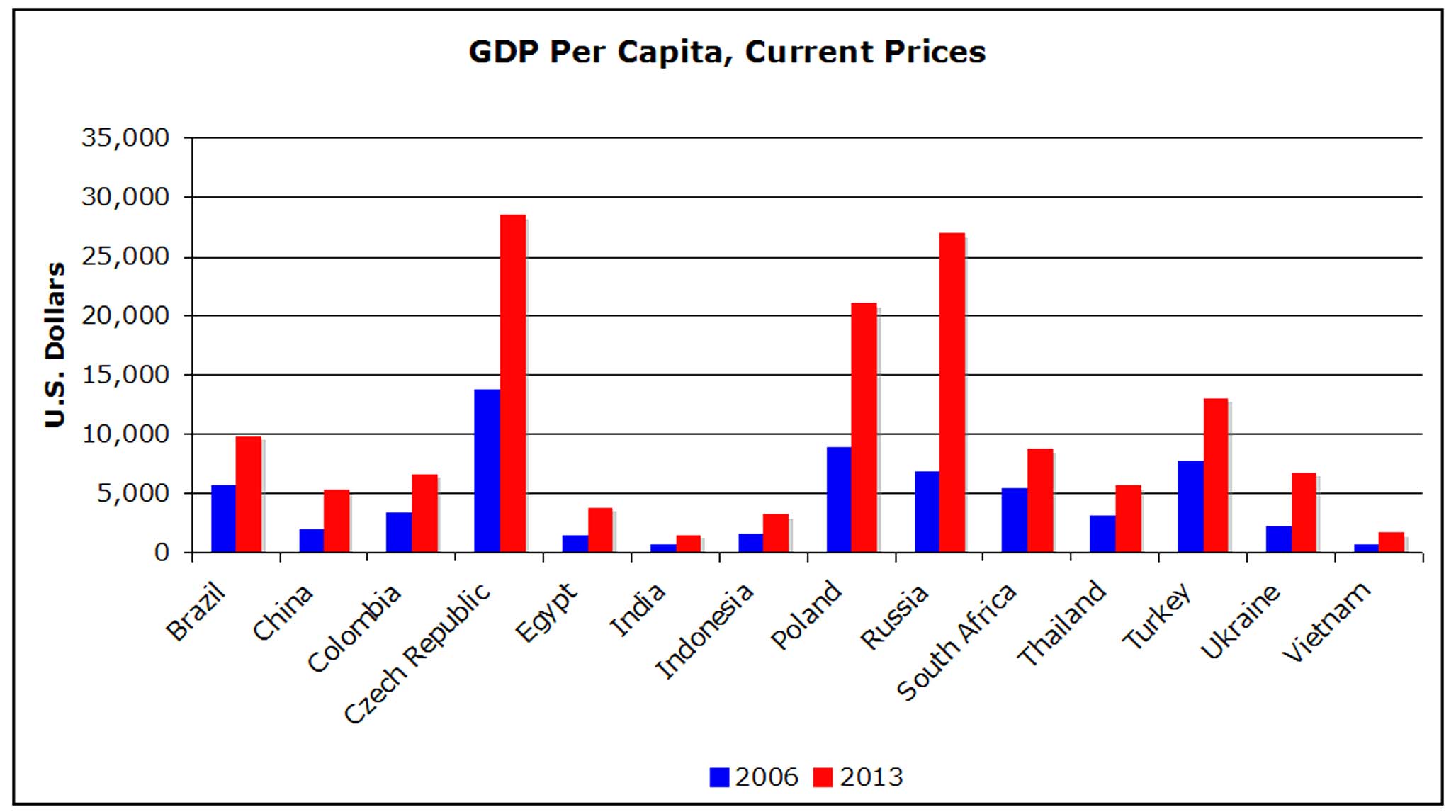

Today throughout the developing world we observe rising per capita GDP, widening income distribution, a move toward higher value added manufactured goods, and greater exports. This increase in wealth has in concordance led to a larger domestic market for goods and services. Moreover, we are seeing the development of modern infrastructure in many domains from transportation to education.

Interestingly, central bankers in these economies have done a decent job with managing fiscal and monetary policy as evidenced by improved economic conditions and an increase in the number of emerging market countries receiving credit upgrades. Two such examples are Colombia and Peru. These countries as a larger group have for the most part been able to do the following:

- Reduce debt to GDP ratio

- Increase the proportion of debt denominated in home currency

- Lower inflation

- Decrease poverty rates

So yes, we can say that the foundation has been laid for the convergence of living standards between developing nations and the developed world. Additionally, the catch-up effect whereby countries that start at a lower economic base grow faster is taking hold, and to a certain extent, we see a leapfrog effect in areas such as telecommunications where the developing world adopts the new technology at a faster rate than when it was originally introduced in the developed world. Due to technological innovations and improvements in productivity, developing nations have realized that they don’t need to follow the exact path of developed nations. In many cases, having no previous infrastructure allows for more rapid deployment of current technology. Two such examples are the direct leap to mobile phones and card payment systems. So even today, in some areas, developing nations can be on equal footing to the western world, or perhaps even ahead as there is no need to change entrenched habits.

Higher population growth rates, which decades ago had been a hindrance to lesser-developed nations as they faced shortages in everything from food to proper education and healthcare, have become advantageous as these nations enter into international trade, commerce, and production. The hands of their young, growing, and eager populations are no longer idle but instead employed in productive manufacturing activities.

Looking ahead we see a number of emerging economies demonstrating their desire to move beyond the function of simple manufacturing and resource outposts, waiting to meet the demands of a western consumer world. Instead countries such as China, India and Brazil have shifted focus to develop their own skilled work force, managerial talent, and higher-level educational institutions. These strategic actions will help to diversify their export base and meet the growing internal consumption needs of their citizens.

Opportunities Abound

Strong growth in emerging markets has created opportunities for investors who are willing to keep an open mind and dedicate time to researching financially attractive targets (FAT) in these regions of the globe.

One such opportunity is Bajaj Auto Ltd. (BJAUT:IN), a Bombay based manufacturer and distributor of motorized scooters, motorcycles and mopeds. It is ranked as the world’s fourth largest two- and three- wheeler manufacturer and the Bajaj brand is well-known across several countries in Latin America, Africa, Middle East, South and South East Asia.

The Company is Attractive for the Following Reasons:

- Sales record of 2.85 million units

- Exports grew 15% to 891,000 units

Strong Financial Performance

- EBITDA has grown to INR 26 billion (CAGR 41%)

- EPS has grown to INR 110 ps (CAGR 43%)

Strong Operating Performance

- EBITDA Margin of 17% (3yr avg.)

- ROE of 45% (3yr avg.)

Compelling Valuation

- Trading at 14X 2011 EPS

- Peers trading at 19X 2011 EPS

Ideally, as a value oriented investor, one would look at this company over a longer period of time, but putting the past operating and financial performance in the context of future growth expectations and a reasonable valuation indicates that Bajaj Auto might be a worthy addition to one’s portfolio. As a note, the company executed a stock split in September of 2010.

Conclusion

As investors seek respite from the worsening fiscal and monetary conditions facing companies and governments that operate in the developed world, diversifying their portfolios to include emerging market investments makes sense. While, the short term cyclical outlook might be still somewhat volatile, considering the fallout from the U.S. downgrade, the longer-term secular outlook suggest that investors need to hold an increasingly larger proportion of their portfolios in emerging markets securities.

Garnet O. Powell, MBA, CFA

I am honoured to have been able to share with you my thinking on the investment process and would be delighted to hear your thoughts.