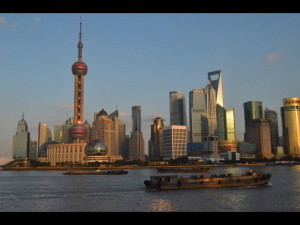

The term ‘emerging markets’ refers to all developing countries that are beginning to experience liberalization and rapid economic growth. Among them are Russia, India, China, Brazil, South Africa and Mexico.

The term ‘emerging markets’ refers to all developing countries that are beginning to experience liberalization and rapid economic growth. Among them are Russia, India, China, Brazil, South Africa and Mexico.

Over the past decade and a half, growth in emerging markets was twice that of developed nations. Interestingly, industry experts predict that it is unlikely that this trend will taper off in the near future. Economists predict that emerging markets will flourish ever more over the next decade, opening new opportunities for both institutional and retail investors. Prospects further increase as multinational companies from advanced economies take interest in investing in these regions with an eye on the rising affluence.

Simply put, emerging markets can be incorporated into the portfolio of long-term investors that are looking for diversification, and not necessarily those with a higher risk tolerance. Competition to unearth investment opportunities that provide adequate returns in the developed world is huge; but as market participants gravitate to the same space, returns become truncated. For instance, in the US, Canada, Japan and Europe, the return on fixed-income type instruments in some cases is near zero. In many cases, markets are outright saturated. These issues should force investors to look for untouched stones, i.e., emerging markets.

Nevertheless, often both the investment risks and opportunities of emerging markets are either grossly overstated or understated. For example, the risks of investing in China are typically trivialized; consequently, many company executives believe that they can and should do business there. In contrast, the perception is that investing in Africa is at the extreme high end of the risk spectrum. Often this view is based on inaccurate information about the continent’s market condition. Nonetheless, according to the United Nations Conference on Trade and Development, Africa, among all other emerging economies, offers the highest risk-adjusted foreign investment returns. It is also interesting that China has stepped up the level of investments in several African nations, further demonstrating the opportunities for emerging nations to formulate partnerships among themselves. Moreover, the economies known as the BRICS have accounted for approximately 55% of global growth since the great recession.

However, as with any other investment option, investing in emerging markets has its own risk-reward tradeoffs. The burning question is: How do investors or multinationals from developed countries mitigate the risks and move forward to make the most of the opportunities in the emerging markets? The answer is neither straightforward, nor is the process easy. The first step to reduce risk might be to ensure that companies thoroughly understand their customers, partners and stakeholders. This highlights the importance of thorough due diligence. One of the best options to carry out such diligence is to establish a business-to-business alliance (B2B) in the host country. Another good and effective way is to form public-private partnerships or sign business-to-government agreements. Both of these steps can bring down the risk by a considerable amount. An alternative way of minimizing the risk is to open an office in the host country and monitor business trends for a couple of years before making final decisions.

For obvious reasons, emerging markets are somewhat more vulnerable than developed ones. Thailand is an example of such vulnerability. In 1997 the Thai government was forced to devalue its currency after having failed to defend it, resulting in a high deficit in the currency account. This also resulted in foreign debt and shortfall in the government budget. The impact rippled throughout Asia; and currencies in Indonesia, Philippines and Malaysia came under attack from speculators. Even though the IMF offered a rescue package to the Thai government, investors’ confidence did not return until 1999. Things like this typically do not occur in developed countries. Currency risk is one of the greatest risk factors for investors in emerging markets. As one country devalues its currency, others follow suit to keep their own nations’ exports competitive, which can cause dramatic fluctuations in exchange rates. However, the beauty of emerging markets is that while it may be more vulnerable to these kinds of currency swings, it potentially offers a higher rate of return. In addition, there are opportunities for investors to offset currency risk through the derivatives market.

Another factor is that investments in emerging markets have higher liquidity and political risks than domestic investments, which also contributes to their volatility. Given this, it is wise to reduce the risk by diversifying the investment among different markets rather than concentrating in just one. Depending on risk tolerance, objectives and goals, individuals and companies can allocate 5% to 10% of their stock portfolio into emerging markets in order to optimize diversification.

Currently, ‘emerging market economies’ as a group are quite large and are likely to become more influential relative to developed economies. At present, the number of households in Brazil, Russia, China and India with more than $10,000 in disposable income is comparable to either Europe or the U.S. Again it is anticipated that over the next ten to fifteen years, more households will join this demographic threshold and will overtake the combined number of households in the U.S. and Europe. It means that future opportunity for investors rests in exploring the increasing prosperity in developing countries, shedding an entrenched bias to the U.S. and Europe. This is a great opportunity for investors that have traditionally concentrated in developed economies to explore new avenues in emerging markets.

Garnet O. Powell, MBA, CFA

I am honoured to have been able to share with you my thinking on the investment process and would be delighted to hear your thoughts.