Both the crude oil market and the equity market dropped sharply during the first quarter 2016. It was a sluggish start to the new year, although both markets have reversed some of their earlier losses in recent weeks. The precipitous fall has been due to an economic slowdown in China, uncertainty over future rate hikes by the Federal Reserve, and deflationary pressures across the world.

Chinese slowdown

It’s clear from the above chart that China’s annual GDP growth rate has slowed down significantly since 2012, with 6-7% seemingly the new normal.

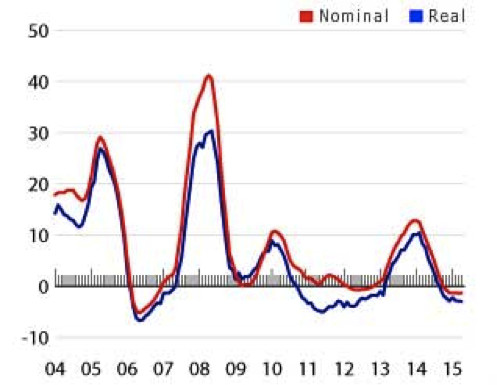

Annual housing price change

The Chinese housing market has also experienced much turbulence lately. After reaching bubble proportions in 2008, house prices saw a big slump in 2009. To rectify the problem, China’s government intervened and eased property norms for buyers, which allowed activity to pick up. However, the Chinese authorities had a difficult time maintaining order in that sector of the economy, which has led to a seesaw ride in the housing market. The Chinese government has not been able to manage the property bubble effectively, raising serious questions about its ability to handle the current slowdown across the broader economy

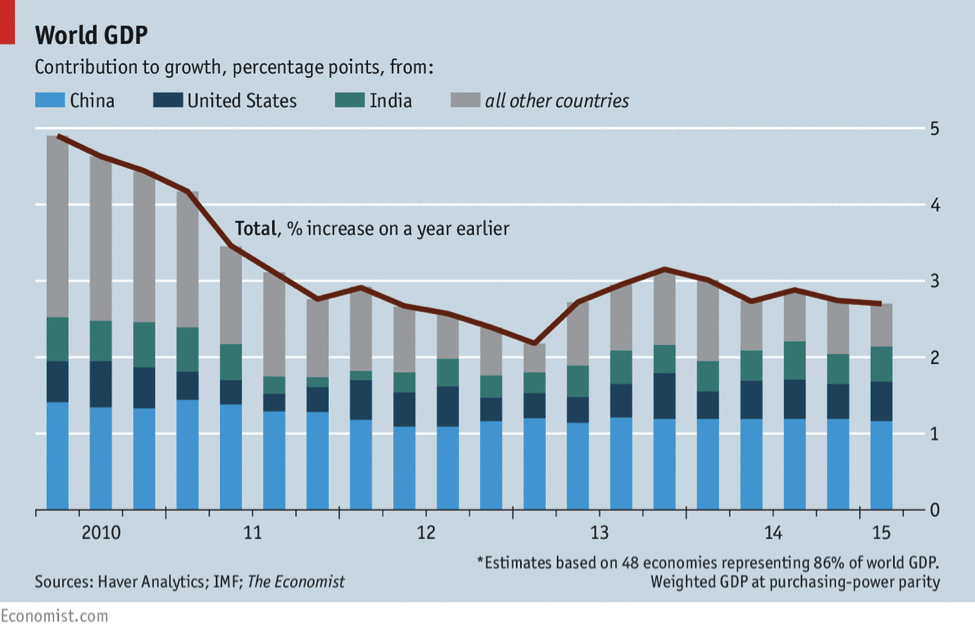

So why does this matter? Because China has been the main contributor to global growth over the last 15 years or so. Nonetheless, China’s proportionate contribution to global GDP is slowly waning against a backdrop of declining global growth. With falling numbers from China, the US, EU and Japan, it’s difficult to ascertain which nations are going to drive global growth going forward. The situation has sparked much chatter about a global recession.

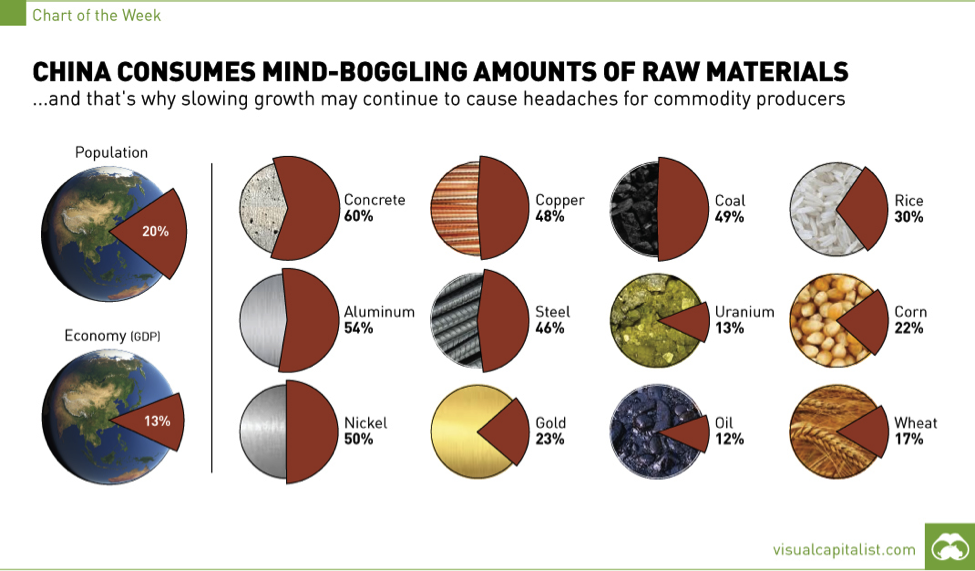

Global Prices are falling due to a slowdown in China

China is a major consumer of most commodities. With the slowdown in China, most global commodity prices have fallen to multi-year lows. However, the fall in crude oil is more likely due to the global supply glut and a flattening demand in that market.

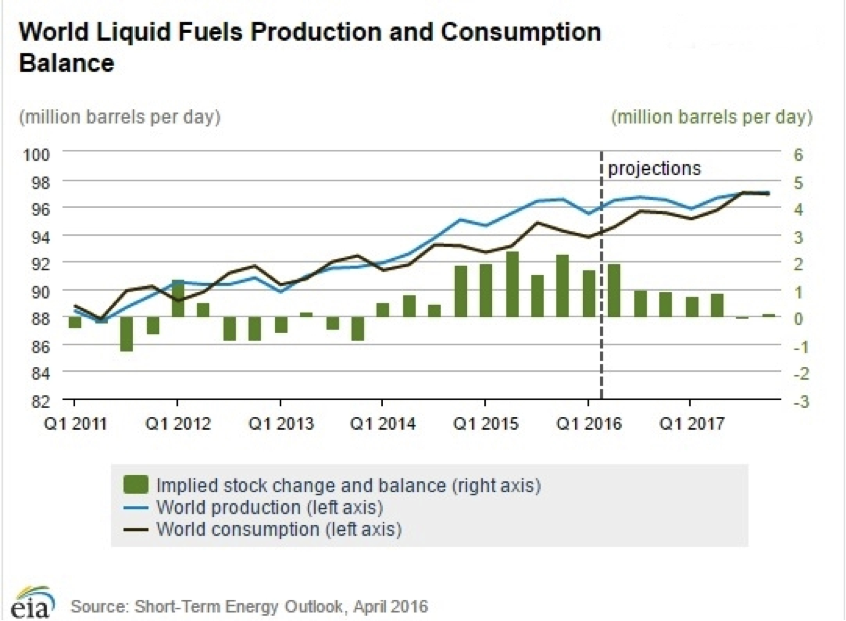

Supply glut in Oil is the main reason for its drop

The Short-term Economic Outlook (STEO) report by the US Energy Information Administration indicates that the glut in oil supply, which began in 2014, is likely to remain until the end of 2016:

Excess crude oil production, coupled with lower global growth, has driven crude oil prices lower. None of the major producers of crude, such as the US, Russia and OPEC, have reduced production, which could lead to a further drop in prices. Moreover, many analysts have lowered their forecasts for the market, with the most bearish pricing WTI crude at around $20 USD per barrel. While it is difficult to predict the exact path, the market will remain volatile and the analysis complicated by temporary supply disruptions in key areas of the globe. Nonetheless, the high level of pessimism could very well create exceptional opportunities for those long-term investors willing to sift through the rubble.

Low crude oil prices causing deflationary fears around the globe

In the last 18 months, crude oil prices have dropped significantly and touched 12-year lows. Such a quick drop is detrimental to those nations dependent on crude oil for global trade. Furthermore, major Central Banks around the world are struggling to raise inflation to their respective target levels. Lower crude oil prices have stoked fears of deflation across the world.

Alberta is struggling due to low oil prices

In previous years, Alberta’s oil industry has been a key driver of Canadian economic growth, but with crude oil prices now languishing at around $45/barrel, Alberta’s economy – and indeed, Canada’s – is struggling. 63,500 jobs were lost in Alberta during the first eight months of 2015; with oil prices threatening to remain low, more job cuts are in the offing. One strange occurrence has been the recent March jobs report from Statistics Canada which showed that the province created 19,000 new jobs. It should not be a surprise to see this number revised in the future. The provincial budget deficit for Alberta could be closer to $8 billion if oil prices remain low, according to John Rose, City of Edmonton’s chief economist. With the EIA’s “Short-Term Energy Outlook” forecast of $40 for 2016 and $55 for December 2017, the situation could get worse before it gets better.

Conclusion

Deflationary pressures, geopolitical tensions, and uncertainty about China sparked volatility in equity and commodity markets in the first quarter. Although major equity indexes have since rebounded, the recovery is still uncertain but will continue to present unique opportunities. The US Fed increased interest rates in December 2015 but has kept them at the same level since, principally due to concerns over a weak global economy. While the ECB has continued to lower rates in order to achieve its inflation target, all eyes are on what the Fed will do for the remainder of the year. Its initial December projection of 4 rate hikes in 2016, however, seems increasingly unlikely.