Over the past decade, investors seeking undervalued growth companies have become more cognizant of the opportunities presented by the BRICS. The emerging nations of Brazil, Russia, India, China and South Africa (collectively referred to as the BRICS) are in the process of finalizing plans for a currency reserve fund and a development bank, which are expected to begin operation as early as 2015. The approved $100 billion reserve fund will serve to mitigate currency swings, while the development bank will provide loans for projects in developing countries. China is expected to provide a majority of the capital to the reserve fund, while each country is expected to contribute equally to the establishment of the development bank. Supporters view the crossing of this historical hurdle as a major feat that will give the BRICS nations more clout on the world financial stage. If properly implemented, these initiatives could moderate currency fluctuations (one of the chief concerns in emerging-market investing) and augment the internal-growth capacity of participating countries. Moreover, for investors willing to look beyond the BRICS, there are additional opportunities for portfolio diversification.

Brazil

Brazil, South America’s largest economy, has been in the headlines for the scope of its infrastructure aspirations, especially since it was mandated with hosting the 2014 World Cup and 2016 Olympic games. The Brazilian government and private sector have invested billions of dollars to expand airports and railways to accommodate the estimated 600,000 foreigners who will travel to the South American nation to watch this year’s World Cup. New state-of-the-art stadiums have also been built and old ones have been upgraded. While these temporary sporting events might not add much to Brazil’s economy in the short term, the investment in core infrastructure could pay off down the road. The investment is coming at a time when Brazil’s growth has been relatively weak. In 2013, Brazil’s economy expanded a mere 2.3% – well below the hurried pace of previous years when the country experienced growth upwards of 5% due to strong demand for its commodities by countries such as China.

Brazil, South America’s largest economy, has been in the headlines for the scope of its infrastructure aspirations, especially since it was mandated with hosting the 2014 World Cup and 2016 Olympic games. The Brazilian government and private sector have invested billions of dollars to expand airports and railways to accommodate the estimated 600,000 foreigners who will travel to the South American nation to watch this year’s World Cup. New state-of-the-art stadiums have also been built and old ones have been upgraded. While these temporary sporting events might not add much to Brazil’s economy in the short term, the investment in core infrastructure could pay off down the road. The investment is coming at a time when Brazil’s growth has been relatively weak. In 2013, Brazil’s economy expanded a mere 2.3% – well below the hurried pace of previous years when the country experienced growth upwards of 5% due to strong demand for its commodities by countries such as China.

Russia

The Crimean crisis has had a negative economic impact on Russia and has dealt a huge blow to market growth and foreign investment. Potential investors and top foreign executives have cancelled visits, cut back expansion plans and closed operations due to the ongoing uncertainty of doing business in Russia. The increasingly tense situation could possibly hinder the progress Russia has made in rankings such as the World Bank’s Ease of Doing Business Index, which rated Russia as one of the most-improved countries and placed it tops among BRIC nations, ahead of India, China and Brazil. Though the improvement was meaningful, Russia has had and still has a relatively low rank in the index (92nd) when compared to other emerging nations such as South Africa (41st). However, Russia continues to seek opportunities with allies such as China. As reported on CWAN, the two nations recently signed a deal in which Russia will supply four hundred billion dollars’ worth of natural gas to China.

China

Despite slower economic growth in China, the world’s most populous country, opportunities still exist. China’s economy grew by 7.7% in 2013, nearing the slowest pace in fourteen years. China has seen slowing demand, which has been worsened by oversupply. Further, the country is in need of reforms to guarantee more stable longer-term growth, although at a lower rate. In order to accomplish this, President Xi Jingping is attempting to reposition the economy away from a heavy reliance on investments and exports, and towards more domestic consumption. Accomplishing this is difficult because of mounting evidence that state-owned bank loans made during the financial crisis are going sour, and due to uncertainty of the size of the shadow-banking sector.

Despite slower economic growth in China, the world’s most populous country, opportunities still exist. China’s economy grew by 7.7% in 2013, nearing the slowest pace in fourteen years. China has seen slowing demand, which has been worsened by oversupply. Further, the country is in need of reforms to guarantee more stable longer-term growth, although at a lower rate. In order to accomplish this, President Xi Jingping is attempting to reposition the economy away from a heavy reliance on investments and exports, and towards more domestic consumption. Accomplishing this is difficult because of mounting evidence that state-owned bank loans made during the financial crisis are going sour, and due to uncertainty of the size of the shadow-banking sector.

Nevertheless, sectors such as luxury goods and casinos are growing due to secular demand. Additionally, opening the financial system to private enterprise and reducing state monopoly in other sectors such as energy and transportation could be quite beneficial for increasing participation in the economic system by a wider variety of enterprises.

Looking Beyond the BRICS for Portfolio Diversification

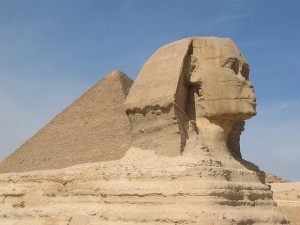

While the BRICS have provided investors with tremendous growth opportunities, investors may want to look beyond these particular emerging-market nations for diversification, higher returns or lower valuations. To expand on the thesis of global investing, one could possibly start by looking at another set of countries that have been grouped into a less well-known acronym, the CIVETS. The CIVETS are the emerging nations of Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa – predicted to rise to prominence in the coming decades. These underdeveloped markets might be classified as frontier markets, though some investors see them as a subsection of emerging markets. Although political instability, currency fluctuations, poor liquidity and inadequate regulations are very real risks, these markets offer potentially high returns for those willing to make calculated investments.

While the BRICS have provided investors with tremendous growth opportunities, investors may want to look beyond these particular emerging-market nations for diversification, higher returns or lower valuations. To expand on the thesis of global investing, one could possibly start by looking at another set of countries that have been grouped into a less well-known acronym, the CIVETS. The CIVETS are the emerging nations of Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa – predicted to rise to prominence in the coming decades. These underdeveloped markets might be classified as frontier markets, though some investors see them as a subsection of emerging markets. Although political instability, currency fluctuations, poor liquidity and inadequate regulations are very real risks, these markets offer potentially high returns for those willing to make calculated investments.

Global investors looking for the next phase of emerging economies should note that the CIVETS have improved infrastructure, controlled inflation and developed adequate financial systems. These markets provide investors with an early-mover advantage which is not as prevalent in the BRICS and is nearly impossible to find in developed markets.

Opportunities in communication and digital technologies can net handsome returns for investors as the relatively young populations take advantage of the internet. The CIVETS have an estimated 176 million internet users, surpassing all European countries, and the number is expected to rise. And just like the BRICS, as the CIVETS gain more wealth, the demand for a greater variety of goods and services will expand, thereby opening more opportunities for investors.