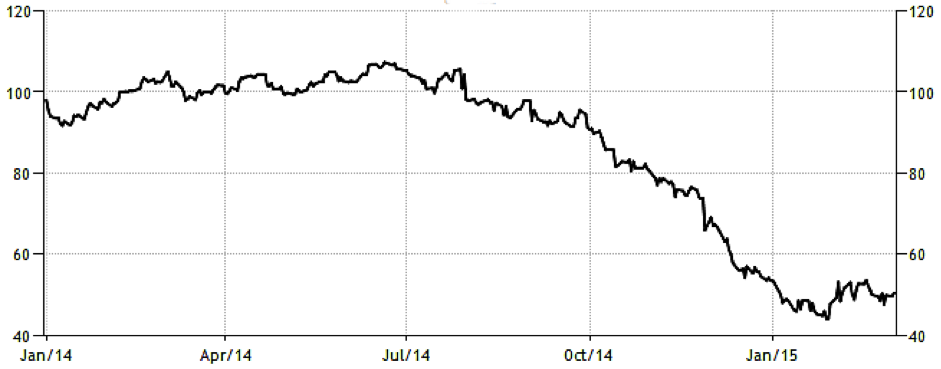

Following the collapse in crude oil prices during the second half of 2014, NYMEX WTI broke through the $50/bbl barrier very soon into 2015 – January 5 to be precise. The $50 mark was breached for the first time since April 2009 and WTI has traded consistently around this level throughout 2015 to date.

Following the collapse in crude oil prices during the second half of 2014, NYMEX WTI broke through the $50/bbl barrier very soon into 2015 – January 5 to be precise. The $50 mark was breached for the first time since April 2009 and WTI has traded consistently around this level throughout 2015 to date.

Source: NYMEX | Trading Economics

The drop in crude prices was an unwelcome surprise to oil and gas exploration & production companies (E&P), particularly to those who had earmarked a crude price above $100/bbl this year. According to a survey in January by Cowen & Company which looked at the capital expenditure (capex) budgets of 476 global E&P companies, capex for projects in 2015 are expected to drop by 17% to $571bn. This figure is based on the assumption of an average WTI price of $70/bbl for the year – hence, working on a $55-$60 basis could result in a decline in capex of 20%.

For the 110 Canadian companies surveyed, a 24% decline in capex is expected, with Encana Corp. and Husky Energy Inc. expected to cut this year’s budgets from 2014 levels by 47% and 37% respectively. Based on the expectation of $70/bbl WTI, the 186 US companies surveyed are cutting capex this year by an average of 22% to $119bn.

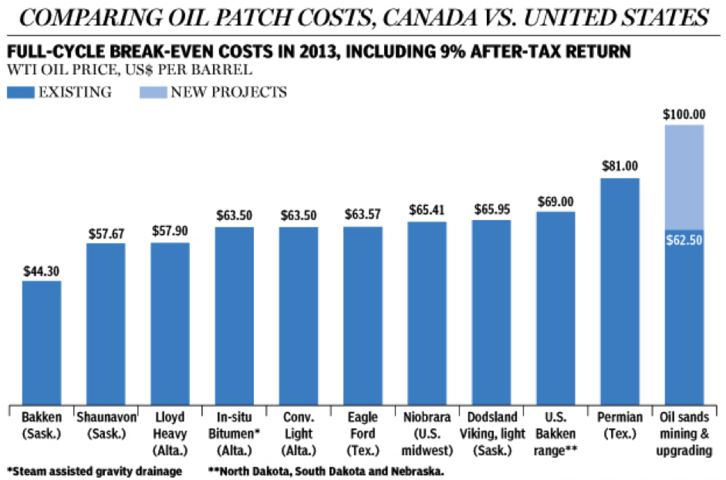

According to a recent study by Scotiabank, moreover, it is cheaper to produce a barrel of oil in Western Canada than in the US. The report calculates the Saskatchewan Bakken area to have a break-even cost of US $44.30/bbl, while oil from existing oil sands mining and upgrading projects is produced at a break-even cost of between $60/bbl and $65/bbl. New oil sands projects, however, are expected to require $100/bbl to break even, which explains why several E&P companies are putting some new projects on hold. Those with stronger balance sheets, however, have gone ahead with projects under the expectation of higher crude prices in the future. In contrast, the Scotiabank report calculates the break-even cost for US Permian basin oil at US $81, for US Bakken at US $69, and for the US Eagle Ford at $63.57.

Source: Scotiabank | Financial Post

Nevertheless, such a sharp oil price decline has meant that several E&P companies are now facing significant liquidity problems and declining margins. Canadian Oil Sands Ltd recently cut its dividend in order to maintain capital, as well as revealing a $1.9bn debt for last year’s fourth quarter. Newfield Exploration, a relatively large US oil and gas producer operating in the Anadarko Basin, the Uinta Basin, the Eagle Ford and the Williston Basin, is seeing an average break-even cost of around $75/bbl across its overall barrel production this year. It has therefore reduced its capex budget by 40% to $1.2bn and introduced an equity offering to raise liquidity, which will mitigate leverage concerns to some extent.

Problems have also started to emerge in the energy services sector, such as drilling, which is very much dependent on the E&P sector. Last month Precision Drilling, Canada’s biggest drilling contractor, reported a USD $90.7mn loss for last year’s final quarter, citing low oil prices as the main reason for declining demand for its rigs. The quarter saw Precision’s rig count in the US fall from 100 to 86, and from 79 to 93 in Canada. The US’ biggest onshore and offshore driller Nabors Industries similarly posted a heavy loss for the same quarter.

For the weaker E&P players with more-leveraged balance sheets, reducing capex and raising equity may not be enough, however. Ivanhoe Energy, a Vancouver-based oil company with a Tamarack oil sands project in Alberta, filed for bankruptcy protection in January, principally attributing the move to the oil price slump. The company already had regulatory issues with one of its Alberta projects prior to the oil price collapse. While under protection from creditors, Ivanhoe has explored options of selling assets and restructuring debt in order to recapitalise. However, since then its stock has been suspended from trading. As a result of these situations, Ivanhoe has been forced to suspend its operations in Ecuador and now faces the impending threat of insolvency.