Down 1127.27, Up 1540.48, down 4034.23, up 1086.25, the Dow’s last six weeks have been a wild ride indeed. Mr. Toad, a Middle Ages thought leader rivalling Occam, nailed it—Semper Absurda, Todi Acceleratio (Coat of Arms, Toad Hall, Disneyland). With Toad at the wheel, we pass Slip-Slop Grade and toboggan down Abyss Road. As we approach the Great Gaping Gorge, we catapult away from the precipice, back up Abyss Road. Toad is nervous.

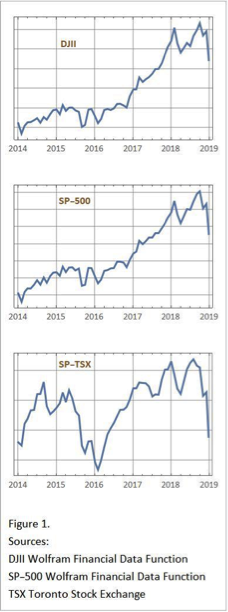

A host of factors including but certainly not limited to the Trump show with the Syria withdrawal and Mattis’s resignation in center ring, Fed tightening, the partial shutdown, uncertainty about divided government in Washington, Canada’s arrest and planned extradition to the US of Huawei’s CFO Wanzhou, and the fear of Brexit chaos are playing into this sharp, volatile decline. Net selling pressure has pushed the Dow through a critical monthly-chart-twenty-day moving average. A year end bounce drives us toward the support.

A host of factors including but certainly not limited to the Trump show with the Syria withdrawal and Mattis’s resignation in center ring, Fed tightening, the partial shutdown, uncertainty about divided government in Washington, Canada’s arrest and planned extradition to the US of Huawei’s CFO Wanzhou, and the fear of Brexit chaos are playing into this sharp, volatile decline. Net selling pressure has pushed the Dow through a critical monthly-chart-twenty-day moving average. A year end bounce drives us toward the support.

The general flattening and sixty-basis-point decline in long end of the US Treasury yield curve warrants attention. We understand a flight from stocks to more predictable yields, but given the tumultuous state of US politics, we’re less clear about an implied flight to quality and greater US and global economic risk. We must be ever mindful that a strong correlation between an inverted yield curve and recessions tells us nothing about causality.

The TSX has under-performed for most of the year. Canada’s nominal GDP ranks number ten, depending on whose stats you view. We fall somewhat lower on a per capita basis, behind San Moreno but ahead of New Zealand, again depending on whose stats you view. Most non-Canadians see us a friendly, quaint lot—loonies and toonies and all that. Few understand or care that we’re a confederation, some would say a patchwork of provinces with patchwork productivity. Apparently, twenty-five percent of our fellow citizens in Alberta now see themselves better off outside the confederation and raising, for the first time in some forty years, the spectre of provincial secession. Any such reality would have a devastating impact on Canada’s economy while rekindling Quebec secessionist sentiment. Lawrence Salomon has written a brilliant opinion piece in the FP (If Alberta turns separatist, Lawrence Solomon, Financial Post). We’ll be watching.

Emerging Market Opportunities

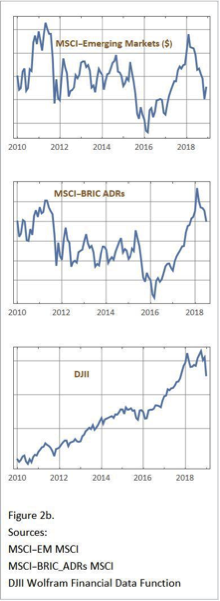

We’re in the preservation and opportunity business. As we have sought to accumulate cash in more pricey markets, we’ll be scouring this deteriorating environment for quality undervalued opportunities. We look here at one potential from the emerging markets.

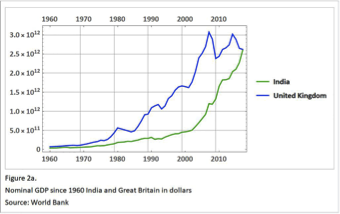

According to the World Bank, India and Great Britain’s GDP converged in 2017 (2.597 versus 2.622 in trillions of dollars, Figure 2a), seventy years after the Raj closed shop. These are top-line numbers which are not meant to trivialize other more socially oriented metrics. Nevertheless, in recent years India has produced extraordinary results, utilizing a fraction of its economic resources. We can only wonder at their prospects if they reduce corruption, lower barriers to entry, and expand educational opportunities.

According to the World Bank, India and Great Britain’s GDP converged in 2017 (2.597 versus 2.622 in trillions of dollars, Figure 2a), seventy years after the Raj closed shop. These are top-line numbers which are not meant to trivialize other more socially oriented metrics. Nevertheless, in recent years India has produced extraordinary results, utilizing a fraction of its economic resources. We can only wonder at their prospects if they reduce corruption, lower barriers to entry, and expand educational opportunities.

We can certainly marvel at the irony of Tata Group’s presence in Great Britain: the purchase of Tetley in 2000, their ownership of the iconic Jaguar and Land Rover brands, their presence in a host of heavy and service industries in Great Britain. This is not an investment recommendation, only a reminder that historical shifts present opportunities, in this case to emerging markets whose market valuations, as Figure 2a suggests, are also declining.

Targets, Not Timing

As markets barrel on in these troubled times, I stick to our value-driven approach and continue to search for companies with strong fundamentals. Yes, it’s a Dickensian enterprise—endless documents, tables, and footnotes. But it suits our clients’ investment goals in their retirement and estate accounts and forces us to focus on targets, not timing per se. Our expectations for results and management drive timing. Our clients’ long-term horizons, ten years and beyond, drive our long-term strategy and can withstand large market drawdowns.

In troubled times, time-horizon confusion coupled with mechanical investment methods which remove us from the immediate financial consequences of corporate decision making can lead account owners to indecision, regret, and panic. The 2008-2009 financial meltdown makes the point. Exotic but vaguely incomprehensible strategies derived say from von Neumann and Morgenstern’s rational agent hypothesis and attendant decision theory offered cold comfort and excruciating regret for those who—for real or imagined reasons—panicked out of their retirement accounts or otherwise experienced horrific losses.

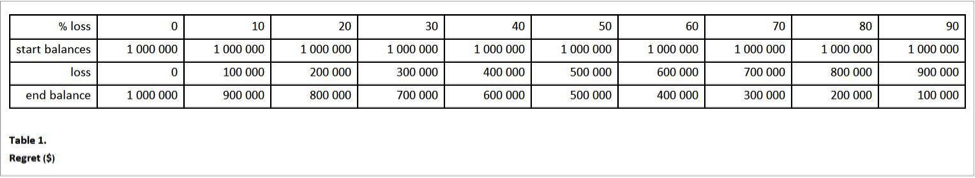

Not to draw a too fine or painful point, find below Table 1, a token representation of the impact of indecision, regret, and panic on a portfolio of $1,000,000.

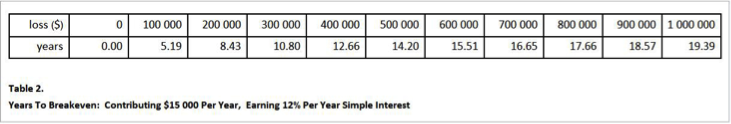

Table 2 shows the years required to recoup these losses assuming simple annual interest of 12% and a $15,000 annual contribution.

This should remind us that our primary responsibility is to preserve capital while optimizing risk. During rapidly falling markets, the burden and responsibility belong to individuals and families who must struggle to understand strategies and combat indecision, regret, and the very real consequences of panic. It may sound preachy, but like it or not, we have to be riveted on the client’s reality when the markets are staring into an abyss, always remembering that on the way down, cash is King. But we’ve been mindful to raise cash in more frothy markets by pruning over valued positions. As always with declining markets, opportunities are shaping up despite the wild ride.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm that manages investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 20 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca