On 7th January 2015, the price of the Brent benchmark crude futures contract briefly slid below $50/bbl for the first time since April 2009. Its US counterpart, NYMEX WTI, dropped below $50/bbl on the previous day, also for the first time since April 2009. The price of crude oil fell precipitously during the second half of 2014 – with WTI losing 46% of its value over the year and Brent more than 48% – and has continued to plummet in 2015. On January 13, 2015 Brent traded close to a six-year low of $45.19. Several factors can explain this recent trend.

On 7th January 2015, the price of the Brent benchmark crude futures contract briefly slid below $50/bbl for the first time since April 2009. Its US counterpart, NYMEX WTI, dropped below $50/bbl on the previous day, also for the first time since April 2009. The price of crude oil fell precipitously during the second half of 2014 – with WTI losing 46% of its value over the year and Brent more than 48% – and has continued to plummet in 2015. On January 13, 2015 Brent traded close to a six-year low of $45.19. Several factors can explain this recent trend.

Supply Factors

One of the main reasons for the fall in prices is the ongoing competition for market share of crude oil that surfaced last year between US shale producers and OPEC. Both parties have called on each other to drop output levels in order to support prices, but neither has done so by any significant degree.

OPEC’s decision in late November to leave its output quota unchanged was notable for causing prices to plummet in its aftermath. Given that Saudi Arabia – OPEC’s most significant member in terms of output – can produce oil at a very low cost and has publicly stated that the group will not reduce output anytime soon, it appears that OPEC’s intention is to wait until US shale producers are forced to cut their supplies to maintain prices above their relatively higher cost levels.

So far, the predicted cut in US output has not materialised. By the end of 2014, the US was producing 9 million barrels per day (bpd) of oil, which is 80% more than it did in 2007. This has contributed massively towards an oversupply that has sent prices southward.

Demand Factors

On the demand side, the cooling of oil prices can also be attributed to last year’s economic slowdown in China, the world’s largest oil importer. China’s economic growth rate is expected to have slowed to a 24-year low of 7.4% in 2014. Expectations of a continuing decline in the growth rate have exerted further downward pressure on the oil price.

Although the US economy showed robust economic growth in the second half of last year, the oil market has responded more to the strengthening US dollar during this period. A weak dollar traditionally attracts speculative funds into the commodities markets; conversely, investment exits when the dollar strengthens. The strong dollar has made the price of a barrel of oil, denominated in dollars, more expensive for investors. Therefore, funds have left oil and other commodities in recent months, adding to the market’s bearish sentiment.

Refined Products

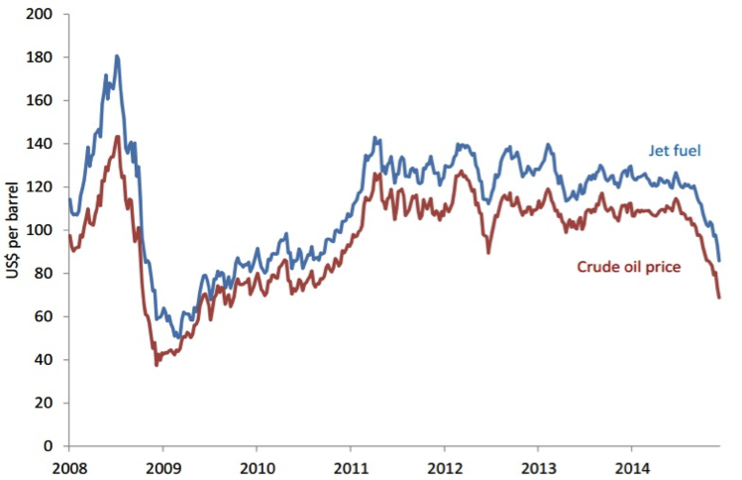

The fall in the oil price has also been accompanied by declines in the prices of crude’s associated refined products. Jet fuel (or kerosene), for example, has followed Brent’s price plunge in a similar fashion:

(Source: IATA | Platts)

The falling cost of jet fuel has allowed airlines to make sizeable savings. According to the International Air Transport Association (IATA), the global airline industry is predicted to post a collective net profit of $19.9bn for 2014 and is expected to rise to $25bn in 2015. IATA expects the industry’s total fuel bill to fall to $192bn in 2015 (which will account for 26% of airlines’ total operating costs) from $204bn in 2014 (28.6% of costs) and $208bn in 2013 (30.1%).

Falling fuel costs have caused airline stock values to skyrocket. In the US, as of mid-December, United Continental Holdings was up 72% over a 12-month period; the newly merged American Airlines Group was up 94%; JetBlue Airways was up 75%; and Delta Air increased 70%.

IATA also expects consumers to benefit from cheaper fuel costs by seeing a drop in airfare prices (before tax and surcharges) in 2015. However, several airline companies have retained the extra surcharges that were imposed on consumers when jet fuel prices were significantly higher. New York Senator Charles Schumer has called for a federal investigation into why the total fare price has not dropped significantly, and why profits and savings in the industry in the US have not been passed on to the consumer.

Schumer has also called for the investigation to cover whether recent airline mergers have played any role in today’s high airfares, on the basis that a lack of industry competition has been cited as one possible explanation for the high fares.

Gasoline prices also tumbled in 2014, ending the year at $2.26/gallon from over $3.60/gallon in June 2014. This can be partially attributed to crude’s price decline, but gasoline has fallen even more dramatically. The ‘gasoline crack,’ which is the price of NYMEX gasoline futures minus WTI crude futures, has declined by 74% since April 2014, meaning that the gasoline refinery margin has become much less expensive. This has translated to a significant fall in prices at the pump, implying that consumers have benefitted substantially.