During the Global Financial Crisis (GFC), virtually the entire advanced world was affected. The world major economies unprecedentedly dropped, global financial conglomerates like Lehman Brothers collapsed, wealth worth trillions of US dollars was lost, and consumer purchasing power hit a record low, decimating production. Employers were forced to cut wage bills, causing millions to join the jobless queues. But of all the G8 members, Australia was able to weather the storm and avoid falling into recession. While Australia’s economy was not entirely immune to the disturbance caused by the GFC, Australians were spared many of the negative impacts of the global meltdown.

During the Global Financial Crisis (GFC), virtually the entire advanced world was affected. The world major economies unprecedentedly dropped, global financial conglomerates like Lehman Brothers collapsed, wealth worth trillions of US dollars was lost, and consumer purchasing power hit a record low, decimating production. Employers were forced to cut wage bills, causing millions to join the jobless queues. But of all the G8 members, Australia was able to weather the storm and avoid falling into recession. While Australia’s economy was not entirely immune to the disturbance caused by the GFC, Australians were spared many of the negative impacts of the global meltdown.

According to IMF, in March quarter 2009, the Australian economy recorded an annual growth of 1.5% while major world economies were stumbling to get back on their feet. This rate outperformed all its counterparts in the G8, whose economies together tapered by an annual rate of 7.8% in the same quarter. Ever since, the Australian economy growth rate, though anaemic, has continued to outperform its counterparts.

The Worst-hit Australian Sectors and Path to Recovery

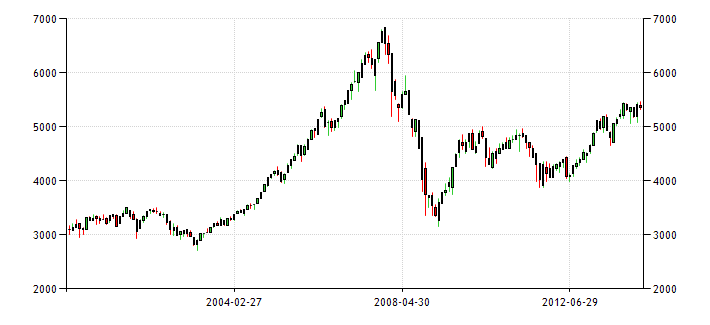

Australia’s equity market was impacted most by the financial sector, the worst hit by the crisis. Between November 2007 and March 2009, stocks fell 54%. Australia’s stock market has since been rising, along with most other major global equity indexes, and is a reflection of general health in the domestic economy. However, it has been five years since the ASX 200 index hit its record low during the GFC, and it is yet to attain its pre-crisis peak. The financials are among the most-improved sectors. Most listed Real Estate Investment Trusts (REITs) and Investment Companies (LICs) have refinanced their debt obligations to strengthen their balance sheets following the GFC.

S&P/ASX 200 Index

Going forward, global investors should keep an eye on companies in Australia’s financial, telecommunications and consumer discretionary sectors. One stock worth noting is BWP Trust (BWP). BWP Trust, which is a REIT that provides premium commercial real estate products, is experiencing stronger growth in profitability. In its latest half-year financial report, released February 2014, BWP showed sound results with a 14.7% increase in distributable profits to AUD $42.9 million. Its portfolio value increased by AUD $256.2 million to AUD $1,634.8 million. The weighted average lease expiry is at 7 years, up slightly over the previous period, and the portfolio is 99.3% occupied. Additionally, the property portfolio is well balanced throughout Western Australia, Victoria, New South Wales, and Queensland. However, its interim dividend fell slightly to 6.83 cents per share from 7 cents a share. This was due to the dilution caused by an AUD $200 million rights issue in September of 2013. The company is expected to perform well going forward as the government pushes incentives for the building and construction industry to help fill the void that is left by the weak mining sector. While these initial indications are positive, investors are best served by a longer-term view of the sector and the stock.

Emerging Markets Ties Prevented Australia’s Recession

The question most asked is this: Why did Australia survive the global financial meltdown relatively unscathed? Well, there are several factors, but most would agree that one of the major reasons is Australia’s trade ties with countries that have an insatiable demand for resources, particularly China and India. These trade relationships generated a healthy balance of trade situation for the Land Down Under. Moreover, the favourable trade situation put Australia in the enviable position of being one of the few advanced economies with almost zero government debt and a resilient economy at the peak of the worst recession since the Great Depression. In fact, Australia has for a long time maintained low government debt, relative to other advanced nations. In addition, the country has a strong financial regulatory framework.

Despite these strengths, to some extent Australia was just plain lucky. Canada, another Commonwealth nation, was also lucky, even with its proximity to the US and close trade ties. Like Australia, there were no bank bailouts as those experienced in the US and UK.

Conclusion

Australian economy is not yet out of the woods. In the wake of slow recovery from the impacts of the GFC, there have been fears that the country might have only delayed the recession. The equity market, which is yet to reach its pre-crisis peak, has been gradually rising, but relatively slow compared to the hard-hit US Indexes. The country’s mining boom is slowly fading, and there has been panic about what will happen in the post-mining era. It was the mining investment boom that helped the nation escape recession. The Australian government has been manoeuvring ways to prepare the construction industry to fill the mining void. Australians and global investors focused on the country’s building-related opportunities are betting that this plan works.