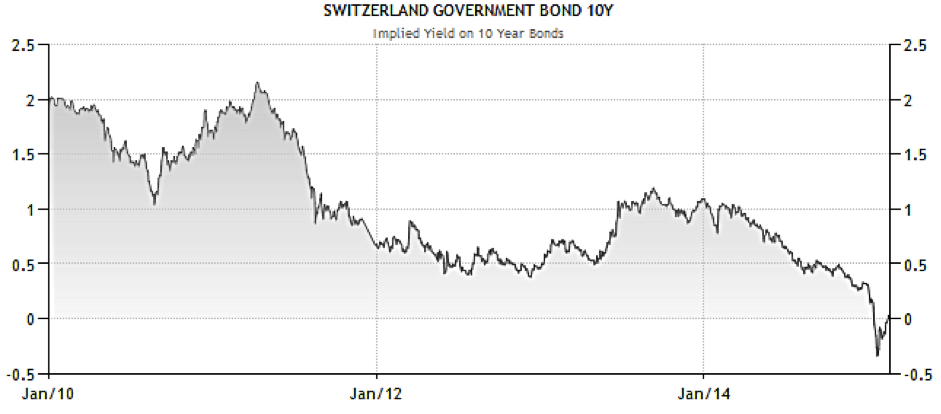

A rare phenomenon is currently occurring in Europe: Investors are actually paying for the opportunity to lend to certain borrowers. The norm, of course, is that borrowers pay lenders for the privilege of borrowing, which therefore accounts for positive interest rates – but in countries such as Belgium, Denmark, Finland, France, Germany and the Netherlands, investors are paying to borrow up to 6 years forward. Indeed, the period extends to 10 years for Switzerland, where the yield is now around -0.03%:

A rare phenomenon is currently occurring in Europe: Investors are actually paying for the opportunity to lend to certain borrowers. The norm, of course, is that borrowers pay lenders for the privilege of borrowing, which therefore accounts for positive interest rates – but in countries such as Belgium, Denmark, Finland, France, Germany and the Netherlands, investors are paying to borrow up to 6 years forward. Indeed, the period extends to 10 years for Switzerland, where the yield is now around -0.03%:

Source: Trading Economics | Department of the Treasury, Switzerland

Eurozone bond yields have fallen consistently over the last few years, after the ECB implemented rock-bottom interest rates in a bid to combat deflation. January’s inflation figure for the region was -0.6%, marking the largest monthly decline in 6 years, with Germany posting a negative figure for the first time since 2009. The addition of the ECB’s quantitative easing program to this already-loose monetary environment has now tipped yields on certain government debt, as well as some euro-denominated corporate bonds (Novartis, Nestle and Royal Dutch Shell, for example), into negative territory. As of early February, 16% of the global government bond market had become negative-yielding, with a total value of $3.6 trillion.

Given the deflationary conditions being experienced in much of Europe, buying a negative-yield bond can still make sense – the real return on a bond (after adjusting for inflation) can still be positive if inflation is more negative than the yield over the bond’s contractual period. It might also be the less expensive choice for banks, given that Eurozone central banks now all have negative deposit rates – in other words, they charge banks to store cash on deposit. Moreover, investors can still make money from negative-yielding euro-denominated bonds if they believe that the value of the euro will strengthen in the future.

This is not the first time that the bond market has witnessed negative yields, however. Japan is perhaps the most notable previous example of this occurrence when its short-term yields went below zero back in January 1997. What followed in that instance was one of the longest bear markets ever experienced in an industrialised economy. In fact, even today the country’s benchmark interest rate remains at 0%, while 5-yr government bond yields also slid to 0% in January.

Europe also briefly witnessed a similar situation in mid-2012 when 2-year bond yields entered negative territory in Austria, Denmark, Finland, Germany, Netherlands and Switzerland. In that instance, the debt crisis was near its peak, which prompted investors to move funds from the beleaguered southern European economies to the safer north. There were also high expectations of the Eurozone soon entering deflation, a situation that has come to fruition today.

While Europe is the sole region experiencing negative yields at the moment, Japan remains teetering close to the edge. The UK and US are expected to raise interest rates this year, which should mitigate some of the bearish bond market sentiment. Bank of America Merrill Lynch, meanwhile, has predicted that five-year Eurozone bonds will decline from -0.05% to -0.10% in the second quarter and that the trend will reverse in the second half of the year, as the effect of the ECB’s stimulus program begins to translate into more encouraging releases of Eurozone economic data.