In the last 12 months, the US economy has experienced a significant improvement in labour market conditions, particularly with regards to job creation. The US created 257,000 jobs in January – the twelfth consecutive month that job creation has exceeded 200,000 – while over the last three months on average 336,000 jobs per month were added, marking the fastest 3-month rate of job creation since 1997. Overall in 2014, just over 3.1 million jobs were created, an annual amount not seen since 1999.

In the last 12 months, the US economy has experienced a significant improvement in labour market conditions, particularly with regards to job creation. The US created 257,000 jobs in January – the twelfth consecutive month that job creation has exceeded 200,000 – while over the last three months on average 336,000 jobs per month were added, marking the fastest 3-month rate of job creation since 1997. Overall in 2014, just over 3.1 million jobs were created, an annual amount not seen since 1999.

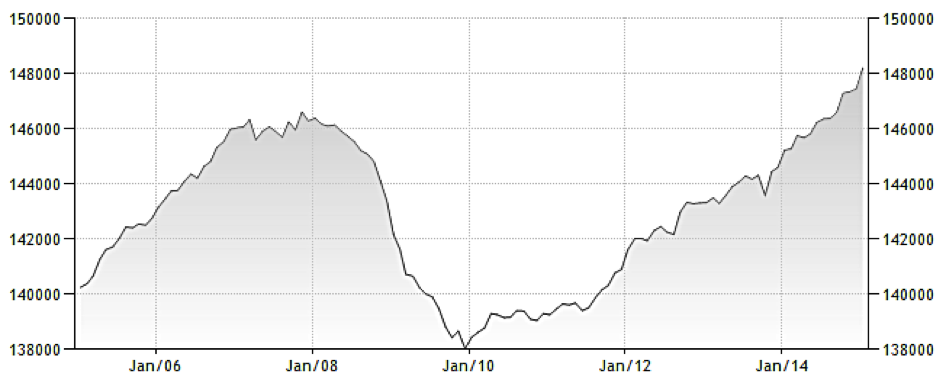

In January, 148.2 million people in the US were recorded as employed, which is an all-time high:

US Employed Persons, Jan 05 – Jan 15 (Source: Trading Economics | US Bureau of Labor Statistics)

Since the worst of the Great Recession in late 2009, over 10 million more people are now in employment; 7,560,000 more private sector jobs have been created since President Obama took office at the beginning of 2009.

One notable concern, however, has been the continuing decline in the US labour force participation rate, which fell in December to 62.7%, a level not seen since 1978. The participation rate measures the proportion of the working population who are in employment or who are actively seeking employment. Although rebounding slightly in January to 62.9%, the participation rate has been falling consistently for the past 7 years. Since mid-2007, approximately 5 million Americans have left the workforce and are not actively seeking employment.

US Labor Force Participation Rate, Jan 05 – Jan 15 (Source: Trading Economics | US Bureau of Labor Statistics)

According to a study conducted last year by the Federal Reserve Bank of Philadelphia, a major impact of the Great Recession was to increase the number of discouraged workers who dropped out of the labour force altogether, thereby contributing to the dwindling participation rate. More recently, the decline in the labour force participation rate has also been attributed to an increasing number of permanent retirements, mainly in the Baby Boomer generation.

There is also a strong possibility that the US will soon run out of college-educated workers to employ. The unemployment rate for this group, specifically for those who hold a bachelor’s degree, fell to 2.8% in December, which is the lowest level since September 2008. The scarcity of labour supply within this group suggests that companies will most likely have to increase wages to attract further employment. Indeed, earnings figures are already starting to support this view: average hourly earnings for the US labour force rose by 0.5% in January, the largest monthly growth rate since November 2008, while on an annual basis hourly wages have increased by 2.2%, up from 1.9% in December.

There does, however, appear to have been a large influx of foreign workers since 2009. The US Center for Immigration Studies recently released data showing that a total of 5.46 million non-immigrant foreign workers were issued work permits (Employment Authorization Documents, EADs) since Obama took office. Of these, 1.03 million were issued in 2014, which is less than the 1.27 million in 2013 but still significantly more than the 0.69 million and 0.77 million EADs issued in 2009 and 2010 respectively. This inflow of foreign workers can partially explain the increase in US employment levels at a time when Americans have exited the workforce, and therefore may also suggest that the labour market is not close to overheating.

Nonetheless, the combination of record employment levels, low participation rates and impending wage inflation all suggest that the US economy is nearing full employment.

In Canada, meanwhile, job creation has been more muted, with only 10,000 jobs a month created last year on average. Carolyn Wilkins, Senior Deputy Governor of the Bank of Canada, recently asserted that the Canadian economy was still 270,000 jobs short of full employment, which is indicative of the weak economic recovery in Canada since the recession and which lends support for a further interest rate reduction.

Furthermore, several business groups in Canada, including the Canadian Chamber of Commerce and Canadian Association for Business Economics, have recently stated that they want the long-form census, cancelled by the federal government in 2010, to be reinstated. According to The Globe and Mail, these organizations are lamenting the lack of economic and social data required to make informed decisions on where to offer their services and how to train the labour force. Economists have argued that the voluntary household survey, which replaced the long-form census, has made trend analysis more difficult in areas such as income inequality and labour shortages, thus making appropriate policy decisions more difficult.

On previous occasions, when the US economy was strong and the Canadian economy concurrently experienced stagnation, a sizeable number of Canadian professionals moved to the US for better career opportunities and pay. This flight of human capital, known as a brain drain, has been observed since the 19th century. More recently, a quite pronounced brain drain occurred during the 1990s when Canada experienced a net loss of skilled workers to the US. Specifically, better-educated and higher-income earners were the most active in leaving Canada. For example, a study by Statistics Canada found that 12% of the graduates who moved to the US in 1995 were of PhD level – a disproportionately high amount. It’s important to note that the emigrants were mainly skilled in knowledge-based industries deemed important to Canada’s economy, such as high-technology industries.

Given the challenges faced in Canada by the oil price collapse and the fact that job openings in the US rose to a 14-year high in December, the likelihood of such a brain drain occurring again is high. With further wage inflation in the US appearing imminent, this could translate into higher earnings for US-based Canadian workers.