Last year turned out to be a poor one for private pension funds, which suffered significantly from lower funding levels.

Last year turned out to be a poor one for private pension funds, which suffered significantly from lower funding levels.

According to The Washington Post, funding for private pensions fell to levels last seen in 2008 immediately after the financial crisis, despite the fact that the stock market rose in 2014, which would normally complement pension performance.

The Washington Post also cites new analysis carried out by consulting firm Towers Watson, which estimates that companies added $30 billion to their pension funds, a 29% reduction from the 2013 figure. On average, a private pension was 80% funded at the end of 2014, down from 89% the previous year, and the corporate pension deficit is now $343bn – almost double the level it was at the end of 2013.

The explanation for the widening deficit, according to Towers Watson’s senior retirement consultant Alan Glickstein, lies in two main contributing factors.

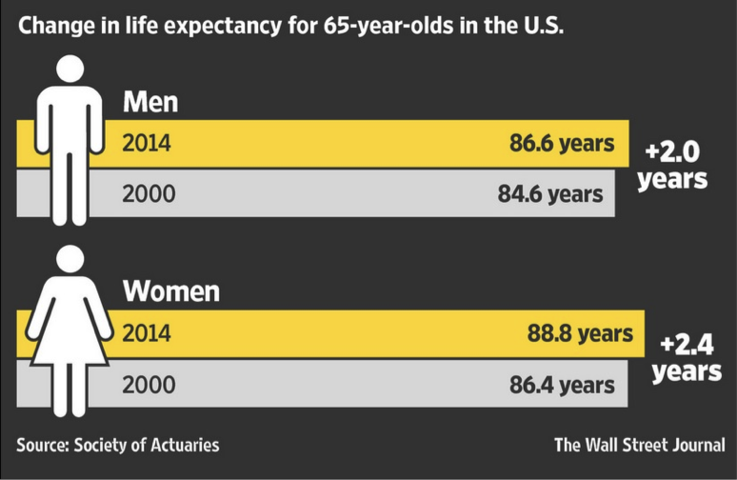

Firstly, in late October the Society of Actuaries released a report on mortality, estimating that a 65-year-old US woman is expected to live 88.8 years on average, up from 86.4 in 2000. A 65-year-old man is expected to live to 86.6 years, up from 84.6 in 2000. Companies use these figures to calculate the amount of funds to be set aside to cover pension obligations.

The estimated increase in male and female mortality contributed to approximately 40% of the pension deficit increase in 2014, according to Mr. Glickstein.

Secondly, when interest rates increase, pension liabilities are lowered. Rising rates will increase the discount rate that is applied to future benefit payments thereby decreasing the value of the liability. An increase in interest rates has made it less costly for companies to de-risk their plans through the purchase of annuities.

Over 400 companies from the Fortune 1000 were examined by Towers Watson, all of which have fiscal years ending 31st December and sponsor US pension plans. The study showed that assets for corporate pension plans reached $1.4 trillion in 2014, which is 3% more than the $1.36 trillion in 2013. The return on investment, on average, was 9%.

Glickstein believes that private pensions were overfunded pre-2008 and then suffered greatly from falling interest rates after the crisis. Lower rates and longer lifespans have cancelled out any benefits the stock market gains contributed to rising pension assets, Glickstein added.