Investing in Art

Investing in Art

As a general rule, when stock markets begin to look frothy and start reaching new highs (as they have done over the past couple of years), art prices are not long in following the pattern. Art has become an investment class all of its own over the past two decades, with institutional investors getting in on the action as well as the usual percentage of private collectors.

However, as one can imagine, investing in an alternative asset such as art, physical gold, classic cars and antiques presents a number of challenges that one doesn’t face when compared with more traditional investment classes such as stocks and bonds. We’ll analyze below some of the challenges that confront the art world.

Issues encountered when investing in art

Issues encountered when investing in art

How does anyone place a value on a piece of art? With stocks or bonds, this is quite easily done (in theory, at least) by summing the present value of future cash flows. This is not so easy to pull off with a painting, for obvious reasons. The only future value you’re looking at is its ultimate sale price (unless you’re charging speculators to visit your museum). Then you have to ask yourself – is there any guarantee that I can sell a piece post-purchase?

This leads us to the next issue of investing in art – as an investment, it is highly illiquid. Although internet sales of art are booming and adding real depth (and transparency) to the market, it’s still not quite at OTC level. Nevertheless, even taking into account this upturn in liquidity, investing in art is a long-term game and shouldn’t be considered if your time horizon is short. If you’re looking to flip art thinking you can easily cash out for a gain in only a few months, think again.

But these disadvantages can be turned to advantages if played right. The art market is still highly fragmented, and gaining good knowledge of what generally sells at what price can lead to good investors cashing in on market inefficiencies. The old maxim “the more you put in, the more you get out” applies here, because there are few shortcuts in the art market. Arguably, more research is required when investing in art than in traditional investment classes if you want to make a stellar return and manage risk.

Advances in art investing

What makes investing in art most interesting (aside from having a beautiful piece on your living room wall for the next 20 years) is the change happening in the art market. Investing in art is no longer exclusively the preserve of men in tweed jackets hiding behind newspapers at auction houses. As previously mentioned, the internet is really beginning to shake up the art market.

The European Fine Art Foundation (TEFAF) estimates that only 10% of the art trade is online. Those who can’t see the potential growth here are likely to be lying to themselves. While high-end art will probably still pass through the hands of private investors in exclusive auctions, the lower end of the market is set to be transformed in the next ten years.

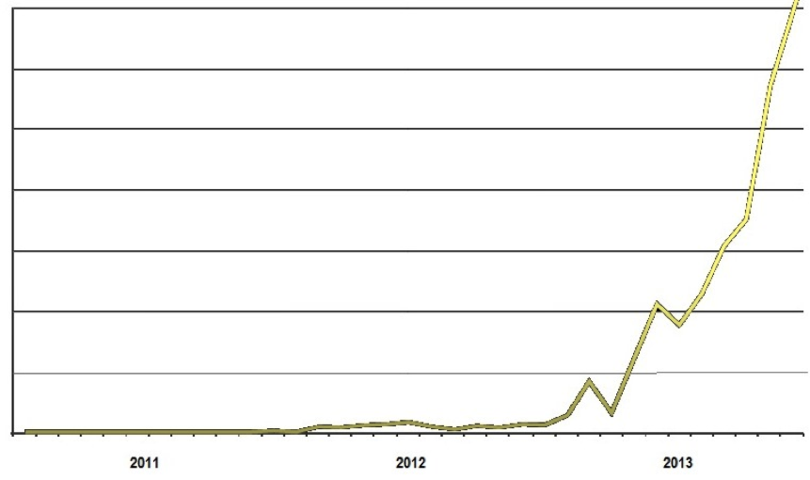

The largest online auction is Artsy.com. Its recently released annual report for 2013 shows that it hosts just under 100,000 images and a total of over 50,000 individual pieces available for purchase. Its audience is truly global – probably the envy of every bricks-and-mortar auction house, in fact. Its visitors in 2013 numbered over 2 million from 180 countries and its growth has been quite phenomenal (see chart below).

Exhibit 1: Growth in Sales on Artsy.com

Source: Artsy.com

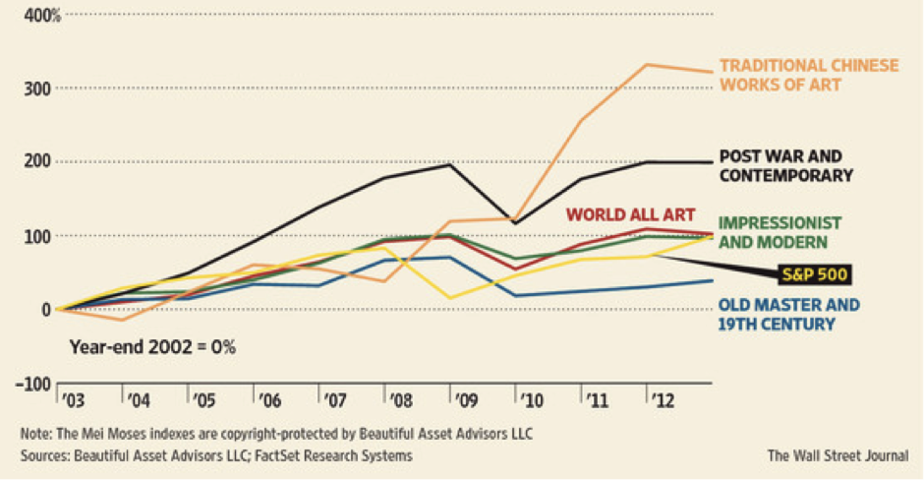

With such advances in market depth brought about by the web, it’s no surprise that indexes are also making an impact. The most prominent of these is the Mei Moses Index, which tracks over 30,000 well-known pieces and their sale prices over time (see below).

Exhibit 2: The Mei Moses Index

Source: The Wall Street Journal

The index is somewhat flawed, of course, by illiquidity in the market, but it does show a move towards a more transparent market. It will likely become increasingly transparent, if Artsy ever decides to make fully public the transactions on their site.

Where to invest?

That is the inevitable question. Beware of any articles or individuals advising you on where to invest in art. The market is full of individuals looking to make a quick buck on naïve but well-meaning newcomers. However, Michael Moses, a co-founder of the Mei-Moses Index (and thus as reliable a source for tips as any), notes that “low-priced art tends to outperform high-priced art.” There you have it: When it comes to investing in art, go long on cheap. And have an eye for value. Good luck!