Recap of the best and worst performing Commodities in 2019

The US-China trade war played havoc with commodity markets last year, with its impact felt across the commodity market from precious metals and crude oil through to base metals and agricultural goods.

Palladium leads the pack

Palladium came through as the frontrunner in the commodities market for the third year in a row, soaring 54.2% in 2019. The precious metal again benefited from its ability to lower emissions in the automotive industry. Supply of the metal has also been uncertain, which contributed to the sharp increase in the value of the commodity during the year.

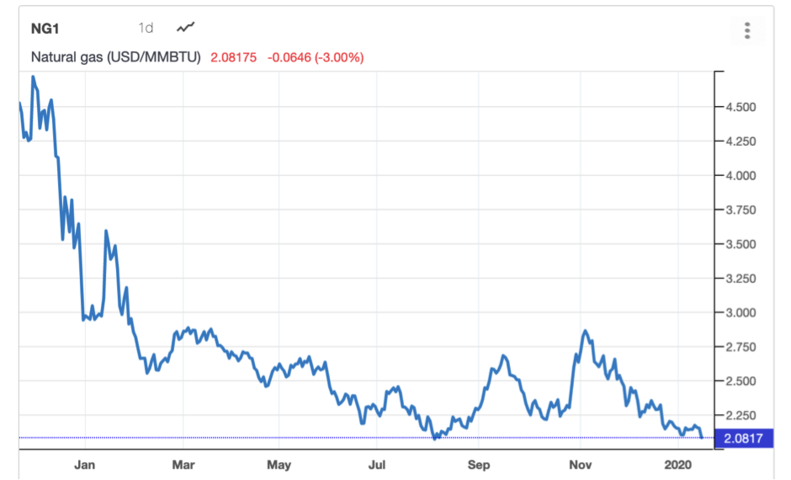

Natural gas prices plummet

At the other end of the spectrum, natural gas had a dismal year. With prices coming off sharply by 25.5% as a result of muted demand and milder winter conditions, natural gas was the worst performing commodity last year.

The US experienced a particularly tough year as supply was boosted by developers building record capacity in the face of slow demand. The Henry Hub benchmark natural gas price slumped 41.6% during 2019, averaging $2.69 MMBtu in 2019 compared with its $3.27 MMBtu average in 2018.

The Canadian natural gas industry had a far better year than the US during 2019, after consistently underperforming its neighbour. AECO’s improved fortunes were a result of a number of natural gas producers pushing for improvements in gas storage, giving them greater access to major markets. The AECO price increased 44.9% to $1.84 MMBtu in December 2019 from $1.27 MMBtu 12 months before.

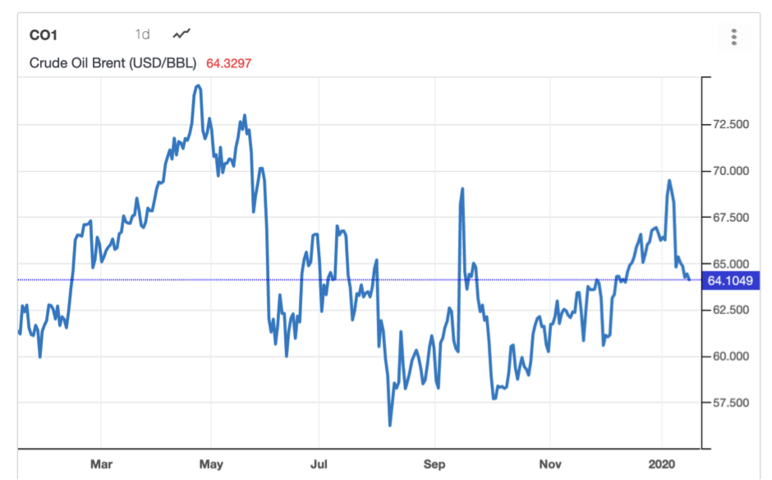

Crude oil buoyed by waning recession fears

Crude oil achieved significant gains during 2019, with Brent crude oil increasing 31.5% during 2019, and WTI 34.4%. Canada’s crude benchmark, Western Canadian Select, didn’t fare quite as well, rising about 12% during the year. Canadian crude came pressure when government lifted output limits, that were put in place due to a lack of pipeline capacity, and oil producers responded by bringing more supply to the market.

The strong gains in crude oil prices disguise what was a volatile year for the commodity price. In September, crude oil prices rocketed in the wake of an Iranian drone attack on Aramco’s Saudi Arabian facilities, which destroyed 5% of the world’s oil reserves. Aramco managed to bring the production capacity back on stream within weeks and oil prices ended the year on a bullish note, buoyed by an 11th hour Phase 1 deal between the US and China.

OPEC is managing production levels carefully. In December, it imposed additional production cuts 500,000 barrels a day until March 2020 to counter the weaker demand it expects come through in the first quarter of the year. The organization will revisit its production cuts in March again when it reassesses the level of demand. Then decide whether to extend the production cuts or not.

The ongoing Iran-US conflict will continue to have an impact on oil prices, as witnessed in the first week of the New Year, when the US assassinated an Iranian Major General. Brent crude oil prices reached almost $70 a barrel after the attack but then came back down as the two countries deescalated the conflict.

Middle Eastern geopolitical tensions will inevitably have an impact on sentiment and global growth prospects, but the oil price’s quick retracement in the wake of the attack highlights that, though still an important supplier, the world’s dependency on oil from the region has diminished to an extent as US production of crude oil has risen.

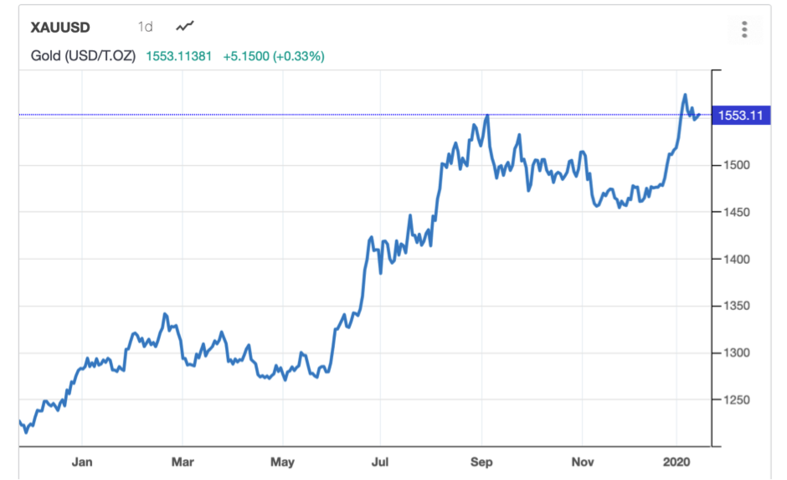

Precious metals profit from safe-haven status

Gold and silver ended 2019 at multi-year highs. Gold experienced its best performance in a decade, gaining 18.3%, while silver increased 15.2%. Although gold managed to achieve significant increases, the safe-haven asset also experienced significant volatility during the year. The price gained 5% in the first month and a half of the year and then quickly erased those gains in the next few months. In May, the bulls took hold and propelled the precious metal price 21.6% in just three months on mounting fears of a global recession and concerns about US-China trade war tensions. Then the price retraced somewhat into the end of the year after the announcement of a Phase 1 trade deal but still managed to notch up a healthy gain for the year.

Base metals

Base metals had tough year, falling victim to the uncertainty surrounding the US-China trade negotiations and global growth concerns. Copper managed to eke out a 3.4% gain, while aluminium, lead and zinc declined 3.4%, 4.7% and 9.6% respectively. Heading into 2020, the direction of base metal prices will be determined by global growth and demand and whether these pick up as anticipated or whether next year proves to be another challenging year for the world economy.

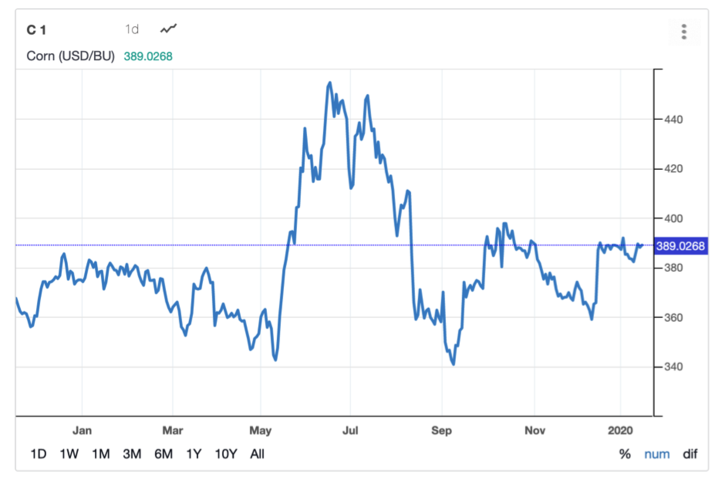

Soft commodities make some headway

Most of the action in the soft commodities was as a result of the US-China tit-for-tat on tariffs, which saw the Chinese putting a ban on US agricultural imports after US President Donald Trump imposed additional tariffs on Chinese goods.

Nevertheless corn and wheat prices managed to gain ground during the year, rising 3.4% and 11% respectively, as their harvests came in smaller than the previous year. Soybean prices were affected by Chinese demand and supply dynamics in response to the African swine flu epidemic there, which wiped out a large part of the Chinese pig population.

According to the January United States Department of Agriculture World Agricultural Supply and Demand Estimates (WASDE) report, corn production in 2019 was estimated at 13.692 billion bushels, down 4.5% from a revised 14.340 billion bushels produced in 2018. Soybean production in 2019 was estimated at 3.558 billion bushels, 20% lower than 2018.

The pork industry experienced shifting supply and demand dynamics as a result of the African swine flu epidemic. Canada got caught in the US-China crossfire when China banned Canadian imports of pork for four months because the country had participated in the Huawei CFO’s arrest on behalf of the US.

In 2020, soft commodities may experience some support from the Phase 1 trade deal in which China has agreed to resume buying agricultural goods. The details of the exact buying commitments are confidential and thus it is difficult to quantify the impact this may have on the US agricultural industry.

Environmental concerns spark mega-protests

Environmentalism and climate change moved centre stage during 2019. Time Magazine’s 2019 Person of the Year was Greta Thunberg, a 16-year old climate activist who inspired youths and students far and wide to engage in demonstrations in 2,300 cities in 153 countries when the UN Climate Summit was held in Madrid.

Countries across the world experienced some of the worst weather disasters on record. These included the Californian and Australian wildfires, the drying up of Victoria Falls in Africa, which is one of the seven wonders of the world, Indonesia had its worst flood in 24 years and Venice experienced its highest tide in half a century.

These considerations are likely to remain under the spotlight in 2020 and will inevitably impact on the global agricultural industry in ways that will be difficult to predict.