CWAN Biannual commodities update July 2017

After a stellar recovery in 2016, it has been a disappointing first half for the commodities complex on the whole in 2017.

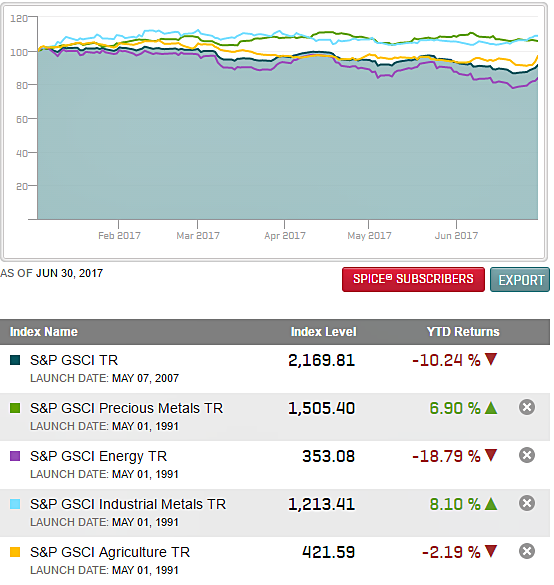

The S&P GSCI, which measures a weighted basket of 24 liquid commodity indices, finished the 6-month period down by more than 10%:

The energy sector led the downturn, with oil, natural gas and coal all finishing in the red. WTI crude and Brent lost 14.5% and 15.9% respectively, with the US futures contract closing at $46.04/bbl on June 30 and the North Sea futures contract closing at $47.92/bbl. Much of the bearish sentiment emerged as a result of disappointment over planned output cuts led by OPEC during the first half, which did little to reduce global crude stockpiles, and thus left supply at near-record levels. Early June saw a particularly pronounced sell-off after top exporter Saudi Arabia and its fellow Gulf allies cut diplomatic ties with neighbour Qatar. The move heightened concerns that tensions within OPEC – of which Qatar is a member – could be inflamed, resulting in a possible failure to remain committed to the promised output cuts.

Canada, meanwhile, looks set for a showdown over a planned expansion of Kinder Morgan Canada’s $7.4 billion Trans Mountain Pipeline. Construction could begin as early as September and would see the current pipeline that runs from Edmonton to Burnaby, B.C., twinned, which would effectively triple its capacity to 890,000 bpd. British Columbia’s possible new government has promised to immediately halt the project once it secures power. While Kinder Morgan’s president Ian Anderson is willing to meet the concerned parties, he has also admitted that his company does not have “any concessions planned for any further discussion at this point.” One of the biggest advantages of the deal is that it gives the province up to $1 billion over 20 years. However, major environmental concerns exist, although the deal was agreed subject to Kinder Morgan abiding by 157 conditions, including various environmental and safety considerations.

Like oil, natural gas also endured a gloomy six months. Mild winter weather in February saw US Henry Hub gas prices plunge to their lowest level since last August, as storage levels declined at a much slower rate than was expected. Indeed, the winter of 2016 in the US was recorded as being the warmest on record, leading to a tepid drawdown in inventories. Although prices modestly recovered during the second quarter, it was not enough to overturn the decline across the first half period, which eventually amounted to 18%.

The two bright spots across the commodities complex during the first half were industrial metals and precious metals. Aluminium was the industrial metals winner, with growing tightness in available inventories and strong physical premiums, and robust buying interest from money managers all helping to support an 18% surge in prices across the period.

On the precious metals front, gold, silver, platinum and palladium all made gains. Indeed, palladium ended the period as the best performer across all products.

The metal ended the period 28% higher, with analysts attributing the rally largely to a supply shortage, as well as bullish speculative activity. Meanwhile, palladium’s precious metal sibling, gold, also fared well during the first half. The yellow metal notched an 8.5% rise in prices during the six months, mostly on the back of strong investor “safe haven” demand for gold-backed ETFs, which in turn was prompted by the high levels of uncertainty pervading financial markets since last year’s Brexit and the election of Donald Trump, whose policies continue to fuel uncertainty.

The worst performer during the first half was sugar, which has dropped by 37% since its peak for the period in February.

A demand shock in top consumer India and expectations of higher supply from the European Union due to favourable weather conditions have helped title the global sugar market from a position of deficit to surplus. Traders were also reportedly concerned about an inventory build-up in Mexico from a lack of exports to the US, although Donald Trump said last week that he has negotiated a new sugar trade deal with Mexico.

In addition, some recent estimates have also suggested sugar demand is rising at the slowest in at least 10 years, as cola and candy are increasingly blamed for an obesity epidemic in more economically affluent countries. At the same time, sugar has to compete with cheap syrups that are increasingly used in processed food.