Tug of War: Earnings, Interest Rates, and Trade Policy

Under Jerome Powell’s chairmanship, Fed policy focus has returned to long-term sustainable growth and economic stability. This is at best a precarious venture in today’s cyclonic seas with the Fed Fund’s target rate as the ship’s primary keel. The target rate has been lifted eight times since December 2015, three times since Powell took over in February. On November 28, Powell hinted that the Fed may slow its rate increase agenda. The Dow rallied 617 points.

Under Jerome Powell’s chairmanship, Fed policy focus has returned to long-term sustainable growth and economic stability. This is at best a precarious venture in today’s cyclonic seas with the Fed Fund’s target rate as the ship’s primary keel. The target rate has been lifted eight times since December 2015, three times since Powell took over in February. On November 28, Powell hinted that the Fed may slow its rate increase agenda. The Dow rallied 617 points.

Whether Powell’s comments were in response to Trump’s ongoing antics or the GM plant closure announcement is unclear and, as with all transitory economic drivers, not central to discovery and implementation of safe harbour investment strategies. To that end, focus on earnings, profitability, and balance sheet fundamentals is more critical than ever to safeguard and protect wealth. I don’t mean by this that we totally ignore drivers. On the contrary, we need to focus on those which illuminate fundamentals. We’ll focus here on the influence of four critical market drivers: interest rates, full employment, corporate profits, and trade policy.

Interest Rates, Corporate Profits, and Full Employment

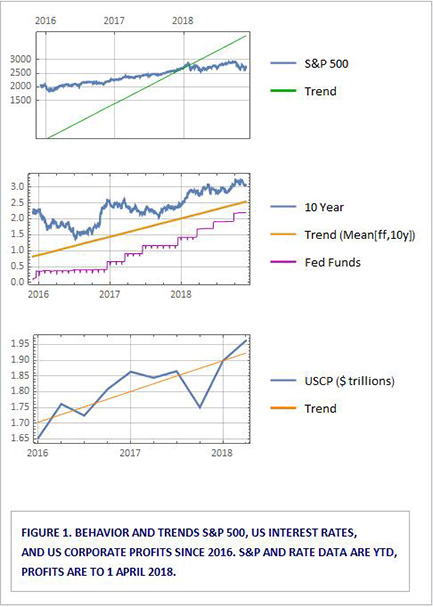

A multitude of companies have reached new market highs this year, lifting the S&P and Dow to record levels. Though rates have continued to rise in 2018, they have remained relatively low by historical standards. Corporate profits and forward earnings prospects have helped offset the drag of rising rates. As Figure 1 makes clear, the slope of the trendline for increasing corporate profits more than offsets the slope of the trendline for higher rates, while the slope of the S&P 500 trendline is steeper than either, reflecting the strength and influence of other factors.

A multitude of companies have reached new market highs this year, lifting the S&P and Dow to record levels. Though rates have continued to rise in 2018, they have remained relatively low by historical standards. Corporate profits and forward earnings prospects have helped offset the drag of rising rates. As Figure 1 makes clear, the slope of the trendline for increasing corporate profits more than offsets the slope of the trendline for higher rates, while the slope of the S&P 500 trendline is steeper than either, reflecting the strength and influence of other factors.

It becomes more difficult for firms to achieve higher profits as the US economy approaches full employment. Companies will continue to replace labor with technology. However, there are capital expenditures and maintenance cost tradeoffs which must be evaluated. Cost cutting that adds to productivity, translates to increased margins, and doesn’t force unintended consequences makes sense in any economic environment. Cost cutting in the current economic environment might signal prudent management. However, given the reluctance of most companies to cut costs in a strong economy, such actions may suggest underlying problems such as shrinking margins, shrinking sales, management issues, or a host of other problems. These are a few salient factors to consider as you evaluate your investments and determine your overall asset allocation.

Hot Wars, Cold Wars, Trade Wars

As of this writing, Trump and his administration have imposed some $241 MM in tariffs. Primarily impacting merchandise and farm goods, affecting any number of countries including Canada, these tariffs have been ordered in the name of national security. Trudeau was incredulous at the imposition in late spring of tariffs against Canadian dairy and manufacturing, “That Canada could be considered a national security risk to the United States is inconceivable.” There were rumours at the time that Trump wanted to send Navy Seals up the Lacolle while he renegotiated the Treaty of Ghent. In any case, NAFTA 2.0—now known as USMCA—has been signed in Buenos Aires. All three country legislatures must now sign on, no mean feat. Meanwhile, the agenda for unwinding tariffs awaits. More recently, Trump’s contradictory statements about tariffs, after his meeting with Xi Jinping, have injected significant market turbulence.

It’s one thing to enrage your friends, another to irritate your adversaries. Your friends don’t expect you to put a gun to their head. Your adversaries have been preparing for it. Many believe that the current US China trade imbroglio is a grave threat to global economic growth and world peace. Even accounting for today’s vast terrain of geopolitical and financial risk, I don’t believe we’re quite there. We may be in sight of the slippery slope that leads to the abyss, but it’s hardly all about US China relations or Trump’s tariffs. Think Brexit, the EU, Russia and the EU, Russia and hybrid war, the Middle East, to name a few.

Historical context supports this perspective. According to the World Bank, as of late 2017, China’s GDP stood at $12.24 trillion compared to $19.39 trillion for the US. For the same year, according to the US Census Bureau, the US imported $505.47 billion from China while exporting back $129.893 billion, a trade deficit of $375.567 billion. These figures are consistent with past years and we can expect more of the same this year. Note that the deficit represents about 3.1% of China’s GDP, 1.9% of US GDP, not earth-shattering.

As of September of this year, according to the US Treasury, China held $1.1514 trillion of US debt or 5.33% of the outstanding $21+ trillion of private and publicly held US debt. This is a decline of 2.7% of their holdings since January 2018. Woods and Greifeld wrote an excellent analysis of China’s declining US holdings in a June 15 Bloomberg piece (China US debt holding analysis Bloomberg June 15 2018). They offer some technical rationale and conclude that a debt for trade confrontation doesn’t currently seem worthwhile to the Chinese. Hard to disagree, at least for now.

That’s not to say the Chinese can’t retaliate. They are world-class players in commodities, real estate, corporate ownership, as well as financial assets. Retaliation in these arenas could cause meaningful disruption to asset allocation strategies. As to the Fed and trade policy, it’s unlikely that a succession of quarter-point Fed Funds hikes from current levels will have much impact. A substantially higher rate environment would be required to do that.

Trump’s use of tariff policy has caused a great deal of uncertainty. The General Motors announcement signals a robust corporate response and appears to substantiate the economic notion that protectionism does more damage to the protected than to foreign exporters. But Trump’s trade policy is only one of many disquieting factors. We’ll have to pay particular attention to ongoing political disruption in the United States and Western Europe.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm that manages investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 20 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca